4-Stage Business Acquisition Process…

Are you looking to sell or buy a business?

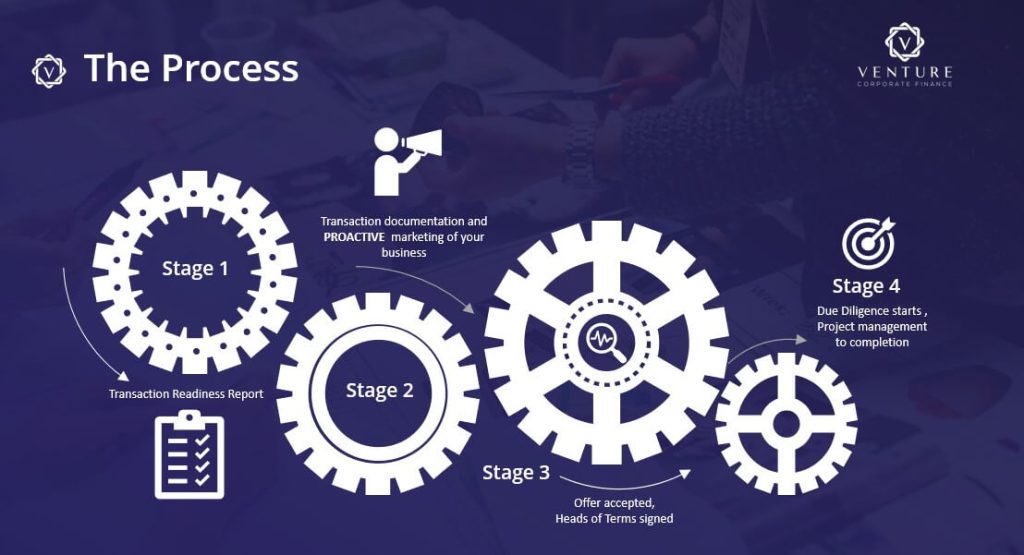

At Venture Corporate Finance, we have developed a four-stage process to help you achieve success in either scenario. This success has resulted in 10 IT/Telco deals being completed in the last 16 months

Selling a business can be a complex and costly process, and it’s important to choose an advisor who is an expert in your sector and can help you achieve your desired valuation.

On the other hand, finding the right company to buy can be a time-consuming and challenging process, especially for smaller buyers.

That’s why Venture Corporate Finance offers a buy and build strategy to help you find a suitable and agreeable acquisition target within a short period of time.

In either case, our four-stage process, sector knowledge, and shared-risk model can help simplify and de-risk the process, and guide you through to achieve the best possible value for your business.

Let’s dive in and see how our 4-stage process can help set you up for success as a buyer or a seller.

FOR SELLERS

Selling a business can be a complex and costly process.

It can also be time-consuming, which can impact the performance of the business and potentially reduce its value.

Without proper guidance, you may end up with a lower value at the end of the sale.

M&A professionals on the buyer’s side are skilled at reducing consideration and finding ways to decrease the amount paid, such as through due diligence deductions and earn-out restrictions.

That’s why it’s important to choose an advisor who is an expert in your sector and can help you achieve your desired valuation.

Let’s take a closer look into the 4-stage process for sellers.

Stage 1: Investigate

Venture Corporate Finance offers a unique four-stage process for selling your business.

Our sector expertise and transactional experience, combined with our shared-risk fee structure, help minimise complications, risk, and costs.

In the first stage, we prepare a Transaction Readiness Report that includes a summary business review, drivers of value, financial summary, market valuation, and a buyers landscape.

This report is provided at no cost to you, except for your time.

Stage 2: Marketing and sale preparation programme

In the second stage, we develop your unique proposition into transaction documentation and prepare you for due diligence, if needed.

This includes creating an Information Memorandum, arranging buyer introduction meetings, setting up a data room, and negotiating with buyers on valuations.

On top of that, we also hold weekly review meetings to ensure the process is going smoothly.

Stage 3: Negotiate Heads of Terms document

The third stage involves negotiating the Heads of Terms document, which outlines the key terms of the buyer’s offer.

We work with you to agree and negotiate this document, as well as introduce all parties, including your legal and taxation advisors.

Stage 4: Project manage due diligence to completion

The final stage is focused on project managing due diligence to completion.

This can be a challenging phase, but our expertise and experience can save you significant costs. We work with you to address any issues that arise, negotiate final terms, and finalize the sale.

In summary, Venture Corporate Finance can help simplify and de-risk the process of selling your business with our four-stage process, sector knowledge, and shared-risk model.

Let us guide you through the process and help you achieve the best possible value for your business.

FOR BUYERS

Finding the right company to buy can be a time-consuming and challenging process, especially for smaller buyers, who may only have a 30% success rate from signing an agreement in principle to actual completion.

Venture Corporate Finance offers a buy and build strategy to help buyers find a suitable and agreeable acquisition target within 3-5 months of engagement.

Let’s take a look at the 4-stage process to help buyers reach success.

Stage 1: Target acquisition

In the first stage of the process, we help you identify and approach off-market targets that fit your strategic objectives and target profile.

We also develop a buyer proposition and provide operational and financial data on potential targets.

We hold bi-weekly meetings to review opportunities and repeat the process until an offer is accepted.

Stage 2: Funding

If needed, we can also assist with funding for your acquisition, whether it be through private equity, a specialist corporate lender, or a high street bank.

We conduct a financial review of your business, develop a funding proposition, and introduce you to lenders.

Stage 3: Completing the deal

Once an offer has been accepted, we work with you to negotiate and agree the Heads of Terms document and introduce legal and taxation advisors, if necessary.

We also set up a data room for formal due diligence and support you throughout the process to ensure a successful completion.

Stage 4: Integration

After the acquisition, it’s important to have a well-thought-out integration strategy to maximize the assets you have acquired.

Venture Corporate Finance can introduce you to an integration specialist and continue to build a pipeline of opportunities, as well as maintain and develop relationships with identified targets.

Looking to Utilise Our 4-Stage Business Acquisition Process?

In summary, Venture Corporate Finance’s buy and build process helps you find and successfully acquire a business, while also providing support with funding and integration.

Let us guide you through the 4-Stage Business Acquisition process and increase your chances of success.